Making Prosperity Common

We’re building a financial system powered by people — where trust, accountability, and shared progress redefine how money works.

We’re building a financial system powered by people — where trust, accountability, and shared progress redefine how money works.

We’re building a financial system powered by people — where trust, accountability, and shared progress redefine how money works.

1.4 billion locked out of the financial system

Behind this number are lives held back, dreams unrealized, and potential left untapped. When access is denied, inequality deepens.

Access Made Affordable

Access Made Affordable

At Rank, we believe everyone deserves a fair chance — no matter who you are or where you’re from. We’re not just creating access; we’re making it affordable. Because when money moves freely and fairly, opportunities open up — and entire communities grow stronger.

At Rank, we believe everyone deserves a fair chance — no matter who you are or where you’re from. We’re not just creating access; we’re making it affordable. Because when money moves freely and fairly, opportunities open up — and entire communities grow stronger.

Why Rank Exists

Why Rank Exists

Rank is a money app for communities. Across emerging markets, communities are more than social units — they are the foundation of everyday life. People live, work, and thrive together through cooperation and mutual support. For decades, this sense of community has quietly powered financial inclusion across Africa.

And this insight isn’t limited to Africa.The behavior is universal: people trust those they know, and progress faster together.

That’s why Rank exists — to reimagine money around trust and togetherness.

Rank is a money app for communities. Across emerging markets, communities are more than social units — they are the foundation of everyday life. People live, work, and thrive together through cooperation and mutual support. For decades, this sense of community has quietly powered financial inclusion across Africa.

And this insight isn’t limited to Africa.The behavior is universal: people trust those they know, and progress faster together.

That’s why Rank exists — to reimagine money around trust and togetherness.

Our Mission

To build a world where financial access unlocks opportunity, fuels shared prosperity, and empowers every person to move forward

Our Vision

To empower people and businesses with simple, inclusive tools to save, borrow, spend, and manage money all in one place— creating pathways to prosperity that reflect their realities and ambitions.

Our Mission

To build a world where financial access unlocks opportunity, fuels shared prosperity, and empowers every person to move forward

Our Vision

To empower people and businesses with simple, inclusive tools to save, borrow, spend, and manage money all in one place— creating pathways to prosperity that reflect their realities and ambitions.

These values aren’t just what we say

These values aren’t just what we say

These values aren’t just what we say

They’re how we build, how we move, and how we help prosperity flow to everyone, everywhere

They’re how we build, how we move, and how we help prosperity flow to everyone, everywhere

R

R

Relentless Ownership

Own it fully—real impact starts with unwavering ownership and courage.

Relentless Ownership

Own it fully—real impact starts with unwavering ownership and courage.

A

A

Act with Urgency Move fast and fearless—seize opportunity today, not tomorrow.

Act with Urgency

Move fast and fearless—seize opportunity today, not tomorrow.

N

N

Nurture Community Build bridges, spark collaboration, and lift everyone along the way.

Nurture Community

Build bridges, spark collaboration, and lift everyone along the way.

K

K

Keep It Clear & Simple

Speak plainly, share context, and make sure nobody’s left guessing.

Keep It Clear & Simple

Speak plainly, share context, and make sure nobody’s left guessing.

E

E

Empathy-Driven Always

Lead with understanding, listen deeply and connect genuinely.

Empathy-Driven Always

Lead with understanding, listen deeply and connect genuinely.

D

D

Drive with Momentum. Always advancing—better for you, better for all, built on shared progress.

Drive with Momentum.

Good enough isn’t good enough — we improve constantly, so we can unlock more for more people.

Leadership

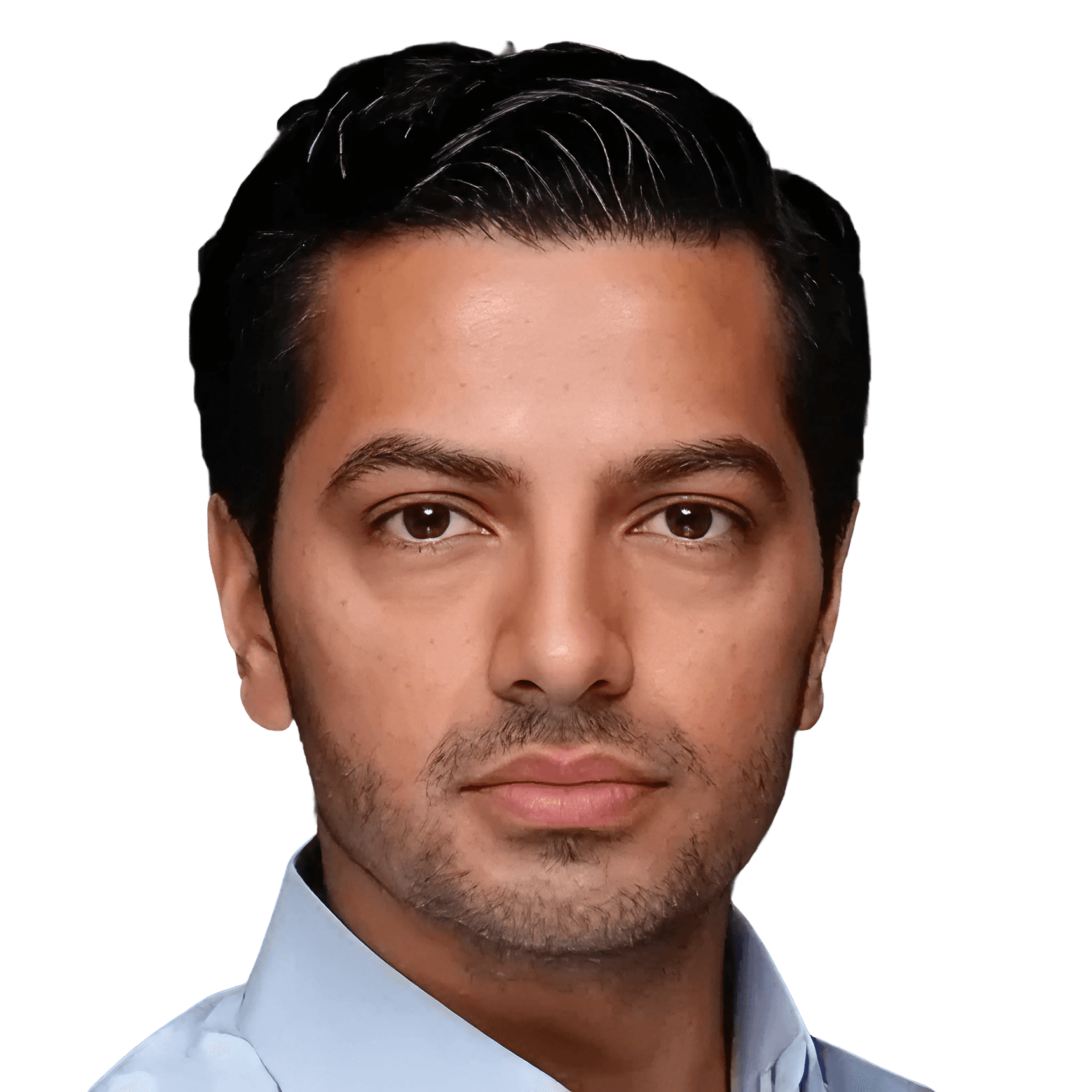

Femi Iromini

Co-Founder/C.E.O

Femi is the Chief Executive Officer of Moni. Before founding Moni, he worked with the World Bank on Nigeria’s Country Private Sector Diagnostic and founded Lead360, an education company bridging the gap between learning and employment. He also served as COO at Antigravity Inc. and has broad experience across agriculture, education, and fintech. Femi has advised organizations including AXA Venture Partners and the African Foresight Group, and held roles at Goldman Sachs. He is a faculty member at CcHub, NGHub by Facebook, and Make-IT Accelerator. He is a Y Combinator Fellow, Ashoka Fellow, and Stanford GSB executive education alumnus.

Femi Iromini

Co-Founder/C.E.O

Femi is the Chief Executive Officer of Moni. Before founding Moni, he worked with the World Bank on Nigeria’s Country Private Sector Diagnostic and founded Lead360, an education company bridging the gap between learning and employment. He also served as COO at Antigravity Inc. and has broad experience across agriculture, education, and fintech. Femi has advised organizations including AXA Venture Partners and the African Foresight Group, and held roles at Goldman Sachs. He is a faculty member at CcHub, NGHub by Facebook, and Make-IT Accelerator. He is a Y Combinator Fellow, Ashoka Fellow, and Stanford GSB executive education alumnus.

Femi Iromini

Co-Founder/C.E.O

Femi is the Chief Executive Officer of Moni. Before founding Moni, he worked with the World Bank on Nigeria’s Country Private Sector Diagnostic and founded Lead360, an education company bridging the gap between learning and employment. He also served as COO at Antigravity Inc. and has broad experience across agriculture, education, and fintech. Femi has advised organizations including AXA Venture Partners and the African Foresight Group, and held roles at Goldman Sachs. He is a faculty member at CcHub, NGHub by Facebook, and Make-IT Accelerator. He is a Y Combinator Fellow, Ashoka Fellow, and Stanford GSB executive education alumnus.

Femi Iromini

Co-Founder/C.E.O

Femi is the Chief Executive Officer of Moni. Before founding Moni, he worked with the World Bank on Nigeria’s Country Private Sector Diagnostic and founded Lead360, an education company bridging the gap between learning and employment. He also served as COO at Antigravity Inc. and has broad experience across agriculture, education, and fintech. Femi has advised organizations including AXA Venture Partners and the African Foresight Group, and held roles at Goldman Sachs. He is a faculty member at CcHub, NGHub by Facebook, and Make-IT Accelerator. He is a Y Combinator Fellow, Ashoka Fellow, and Stanford GSB executive education alumnus.

Dapo Sobayo

CTO/Co-Founder

Dapo is a professional in Risk Management, Technical Analytics, Finance, and Digital Product Management with extensive experience in banking and financial services. Before co-founding Moni, he was Head of Risk at Zedvance, where he led underwriting, automation, and analytics. He also served as Senior Lead for Digital and Credit Analytics at SEL Capital Finance and began his career rising through the ranks at Zenith Bank. As Chief Technology Officer at Moni, Dapo drives product and engineering strategy, ensuring solutions scale efficiently for users. He holds a Bachelor’s degree in Economics from Obafemi Awolowo University.

Dapo Sobayo

CTO/Co-Founder

Dapo is a professional in Risk Management, Technical Analytics, Finance, and Digital Product Management with extensive experience in banking and financial services. Before co-founding Moni, he was Head of Risk at Zedvance, where he led underwriting, automation, and analytics. He also served as Senior Lead for Digital and Credit Analytics at SEL Capital Finance and began his career rising through the ranks at Zenith Bank. As Chief Technology Officer at Moni, Dapo drives product and engineering strategy, ensuring solutions scale efficiently for users. He holds a Bachelor’s degree in Economics from Obafemi Awolowo University.

Dapo Sobayo

CTO/Co-Founder

Dapo is a professional in Risk Management, Technical Analytics, Finance, and Digital Product Management with extensive experience in banking and financial services. Before co-founding Moni, he was Head of Risk at Zedvance, where he led underwriting, automation, and analytics. He also served as Senior Lead for Digital and Credit Analytics at SEL Capital Finance and began his career rising through the ranks at Zenith Bank. As Chief Technology Officer at Moni, Dapo drives product and engineering strategy, ensuring solutions scale efficiently for users. He holds a Bachelor’s degree in Economics from Obafemi Awolowo University.

Dapo Sobayo

CTO/Co-Founder

Dapo is a professional in Risk Management, Technical Analytics, Finance, and Digital Product Management with extensive experience in banking and financial services. Before co-founding Moni, he was Head of Risk at Zedvance, where he led underwriting, automation, and analytics. He also served as Senior Lead for Digital and Credit Analytics at SEL Capital Finance and began his career rising through the ranks at Zenith Bank. As Chief Technology Officer at Moni, Dapo drives product and engineering strategy, ensuring solutions scale efficiently for users. He holds a Bachelor’s degree in Economics from Obafemi Awolowo University.

Dotun Olowoporoku

Board Member

Dotun Olowoporoku is the General Partner at Ventures Platform, a leading early-stage venture capital firm backing Africa’s boldest founders. He brings over 20 years of experience in entrepreneurship, venture investing, and C-level operations across multiple sectors. Before Ventures Platform, he was Principal at Novastar Ventures and Chief Commercial Officer at Moniepoint, where he led fundraising, strategic investments, and expansion efforts. Dotun is also the Executive Producer and Host of the acclaimed Building the Future podcast, featuring conversations with entrepreneurs and innovators shaping Africa’s future. A PhD holder in Environmental Management from the University of the West of England, he has worked as a consultant to global institutions, including the World Bank Group, and is a recipient of the South West England Breakthrough Business Prize.

Dotun Olowoporoku

Board Member

Dotun Olowoporoku is the General Partner at Ventures Platform, a leading early-stage venture capital firm backing Africa’s boldest founders. He brings over 20 years of experience in entrepreneurship, venture investing, and C-level operations across multiple sectors. Before Ventures Platform, he was Principal at Novastar Ventures and Chief Commercial Officer at Moniepoint, where he led fundraising, strategic investments, and expansion efforts. Dotun is also the Executive Producer and Host of the acclaimed Building the Future podcast, featuring conversations with entrepreneurs and innovators shaping Africa’s future. A PhD holder in Environmental Management from the University of the West of England, he has worked as a consultant to global institutions, including the World Bank Group, and is a recipient of the South West England Breakthrough Business Prize.

Dotun Olowoporoku

Board Member

Dotun Olowoporoku is the General Partner at Ventures Platform, a leading early-stage venture capital firm backing Africa’s boldest founders. He brings over 20 years of experience in entrepreneurship, venture investing, and C-level operations across multiple sectors. Before Ventures Platform, he was Principal at Novastar Ventures and Chief Commercial Officer at Moniepoint, where he led fundraising, strategic investments, and expansion efforts. Dotun is also the Executive Producer and Host of the acclaimed Building the Future podcast, featuring conversations with entrepreneurs and innovators shaping Africa’s future. A PhD holder in Environmental Management from the University of the West of England, he has worked as a consultant to global institutions, including the World Bank Group, and is a recipient of the South West England Breakthrough Business Prize.

Dotun Olowoporoku

Board Member

Dotun Olowoporoku is the General Partner at Ventures Platform, a leading early-stage venture capital firm backing Africa’s boldest founders. He brings over 20 years of experience in entrepreneurship, venture investing, and C-level operations across multiple sectors. Before Ventures Platform, he was Principal at Novastar Ventures and Chief Commercial Officer at Moniepoint, where he led fundraising, strategic investments, and expansion efforts. Dotun is also the Executive Producer and Host of the acclaimed Building the Future podcast, featuring conversations with entrepreneurs and innovators shaping Africa’s future. A PhD holder in Environmental Management from the University of the West of England, he has worked as a consultant to global institutions, including the World Bank Group, and is a recipient of the South West England Breakthrough Business Prize.

Investors

Temi Marcella- Awogboro

Partner

Temi is a Partner at New Lion Capital, a venture capital fund investing in tech firms across Latin America, Africa, and Southeast Asia. She co-founded Kairos Angels and MAGIC, building a portfolio of 200+ companies in 25 countries. Previously, she was Executive Director of Evercare Hospital Lekki, a TPG portfolio company, and regional lead of the $1B Evercare Health Fund, backed by TPG Capital, The Rise Fund, and leading global impact investors. Temi began her career at Goldman Sachs International, where she was named a Goldman Sachs Global Leader. She holds an MBA from Stanford Graduate School of Business and a First-Class MA in Economics from Christ’s College, Cambridge.

Temi Marcella- Awogboro

Partner

Temi is a Partner at New Lion Capital, a venture capital fund investing in tech firms across Latin America, Africa, and Southeast Asia. She co-founded Kairos Angels and MAGIC, building a portfolio of 200+ companies in 25 countries. Previously, she was Executive Director of Evercare Hospital Lekki, a TPG portfolio company, and regional lead of the $1B Evercare Health Fund, backed by TPG Capital, The Rise Fund, and leading global impact investors. Temi began her career at Goldman Sachs International, where she was named a Goldman Sachs Global Leader. She holds an MBA from Stanford Graduate School of Business and a First-Class MA in Economics from Christ’s College, Cambridge.

Temi Marcella- Awogboro

Partner

Temi is a Partner at New Lion Capital, a venture capital fund investing in tech firms across Latin America, Africa, and Southeast Asia. She co-founded Kairos Angels and MAGIC, building a portfolio of 200+ companies in 25 countries. Previously, she was Executive Director of Evercare Hospital Lekki, a TPG portfolio company, and regional lead of the $1B Evercare Health Fund, backed by TPG Capital, The Rise Fund, and leading global impact investors. Temi began her career at Goldman Sachs International, where she was named a Goldman Sachs Global Leader. She holds an MBA from Stanford Graduate School of Business and a First-Class MA in Economics from Christ’s College, Cambridge.

Temi Marcella- Awogboro

Partner

Temi is a Partner at New Lion Capital, a venture capital fund investing in tech firms across Latin America, Africa, and Southeast Asia. She co-founded Kairos Angels and MAGIC, building a portfolio of 200+ companies in 25 countries. Previously, she was Executive Director of Evercare Hospital Lekki, a TPG portfolio company, and regional lead of the $1B Evercare Health Fund, backed by TPG Capital, The Rise Fund, and leading global impact investors. Temi began her career at Goldman Sachs International, where she was named a Goldman Sachs Global Leader. She holds an MBA from Stanford Graduate School of Business and a First-Class MA in Economics from Christ’s College, Cambridge.

Kola Aina

General Partner

Kola Aina is the Founding Partner at Ventures Platform, an early-stage venture capital fund backing Africa’s next generation of entrepreneurs. An experienced executive and board director, he blends entrepreneurial, investment, and technical expertise across technology, finance, media, agriculture, infrastructure, and real estate. His portfolio includes high-growth companies such as Mono, PiggyVest, Reliance HMO, and Paystack, acquired by Stripe in 2020. Kola serves as Chair of the Advisory Group on Technology and Creativity to the President of Nigeria and Co-Chair of the Committee on Job Creation & Youth Employment. He also sits on several boards, including ARM Financial Advisers.

Kola Aina

General Partner

Kola Aina is the Founding Partner at Ventures Platform, an early-stage venture capital fund backing Africa’s next generation of entrepreneurs. An experienced executive and board director, he blends entrepreneurial, investment, and technical expertise across technology, finance, media, agriculture, infrastructure, and real estate. His portfolio includes high-growth companies such as Mono, PiggyVest, Reliance HMO, and Paystack, acquired by Stripe in 2020. Kola serves as Chair of the Advisory Group on Technology and Creativity to the President of Nigeria and Co-Chair of the Committee on Job Creation & Youth Employment. He also sits on several boards, including ARM Financial Advisers.

Kola Aina

General Partner

Kola Aina is the Founding Partner at Ventures Platform, an early-stage venture capital fund backing Africa’s next generation of entrepreneurs. An experienced executive and board director, he blends entrepreneurial, investment, and technical expertise across technology, finance, media, agriculture, infrastructure, and real estate. His portfolio includes high-growth companies such as Mono, PiggyVest, Reliance HMO, and Paystack, acquired by Stripe in 2020. Kola serves as Chair of the Advisory Group on Technology and Creativity to the President of Nigeria and Co-Chair of the Committee on Job Creation & Youth Employment. He also sits on several boards, including ARM Financial Advisers.

Kola Aina

General Partner

Kola Aina is the Founding Partner at Ventures Platform, an early-stage venture capital fund backing Africa’s next generation of entrepreneurs. An experienced executive and board director, he blends entrepreneurial, investment, and technical expertise across technology, finance, media, agriculture, infrastructure, and real estate. His portfolio includes high-growth companies such as Mono, PiggyVest, Reliance HMO, and Paystack, acquired by Stripe in 2020. Kola serves as Chair of the Advisory Group on Technology and Creativity to the President of Nigeria and Co-Chair of the Committee on Job Creation & Youth Employment. He also sits on several boards, including ARM Financial Advisers.

Michael Seibel

Partner Emeritus

Michael Seibel is CEO and Partner at Y Combinator, the top startup accelerator backing early-stage tech founders. He joined YC in 2013 and became its first African-American partner in 2014. Michael previously co-founded Justin.tv, which evolved into Twitch and was acquired by Amazon for nearly $1B, and Socialcam, sold to Autodesk for $60M. Earlier, he was Finance Director for NAACP president Kweisi Mfume’s U.S. Senate campaign. He holds a B.A. in Political Science from Yale, where he focused on American government and policy. He has advised hundreds of startups through YC

Michael Seibel

Partner Emeritus

Michael Seibel is CEO and Partner at Y Combinator, the top startup accelerator backing early-stage tech founders. He joined YC in 2013 and became its first African-American partner in 2014. Michael previously co-founded Justin.tv, which evolved into Twitch and was acquired by Amazon for nearly $1B, and Socialcam, sold to Autodesk for $60M. Earlier, he was Finance Director for NAACP president Kweisi Mfume’s U.S. Senate campaign. He holds a B.A. in Political Science from Yale, where he focused on American government and policy. He has advised hundreds of startups through YC

Michael Seibel

Partner Emeritus

Michael Seibel is CEO and Partner at Y Combinator, the top startup accelerator backing early-stage tech founders. He joined YC in 2013 and became its first African-American partner in 2014. Michael previously co-founded Justin.tv, which evolved into Twitch and was acquired by Amazon for nearly $1B, and Socialcam, sold to Autodesk for $60M. Earlier, he was Finance Director for NAACP president Kweisi Mfume’s U.S. Senate campaign. He holds a B.A. in Political Science from Yale, where he focused on American government and policy. He has advised hundreds of startups through YC

Michael Seibel

Partner Emeritus

Michael Seibel is CEO and Partner at Y Combinator, the top startup accelerator backing early-stage tech founders. He joined YC in 2013 and became its first African-American partner in 2014. Michael previously co-founded Justin.tv, which evolved into Twitch and was acquired by Amazon for nearly $1B, and Socialcam, sold to Autodesk for $60M. Earlier, he was Finance Director for NAACP president Kweisi Mfume’s U.S. Senate campaign. He holds a B.A. in Political Science from Yale, where he focused on American government and policy. He has advised hundreds of startups through YC

Olumide Soyombo

Founder, Voltron Capital

Olumide Soyombo is the co-founder of Bluechip Technologies Ltd, a systems integration and technology consulting firm he launched in 2008. Under his leadership, the company has grown from two employees to over 100 consultants across Nigeria, Ghana, Zambia, Kenya, and the DRC. He is also the founder of Voltron Capital, a venture capital firm focused on seed investments across Africa, with a portfolio of more than 20 startups including Paystack, Thrive Agric, Trove, and Accounteer. Olumide holds a BSc in Systems Engineering from the University of Lagos and an MSc in Business and Information Technology from Aston Business School.

Olumide Soyombo

Founder, Voltron Capital

Olumide Soyombo is the co-founder of Bluechip Technologies Ltd, a systems integration and technology consulting firm he launched in 2008. Under his leadership, the company has grown from two employees to over 100 consultants across Nigeria, Ghana, Zambia, Kenya, and the DRC. He is also the founder of Voltron Capital, a venture capital firm focused on seed investments across Africa, with a portfolio of more than 20 startups including Paystack, Thrive Agric, Trove, and Accounteer. Olumide holds a BSc in Systems Engineering from the University of Lagos and an MSc in Business and Information Technology from Aston Business School.

Kola Aina

General Partner, Ventures Platform

Kola Aina is the Founding Partner at Ventures Platform, an early-stage venture capital fund backing Africa’s next generation of entrepreneurs. An experienced executive and board director, he blends entrepreneurial, investment, and technical expertise across technology, finance, media, agriculture, infrastructure, and real estate. His portfolio includes high-growth companies such as Mono, PiggyVest, Reliance HMO, and Paystack, acquired by Stripe in 2020. Kola serves as Chair of the Advisory Group on Technology and Creativity to the President of Nigeria and Co-Chair of the Committee on Job Creation & Youth Employment. He also sits on several boards, including ARM Financial Advisers.

Kola Aina

General Partner, Ventures Platform

Kola Aina is the Founding Partner at Ventures Platform, an early-stage venture capital fund backing Africa’s next generation of entrepreneurs. An experienced executive and board director, he blends entrepreneurial, investment, and technical expertise across technology, finance, media, agriculture, infrastructure, and real estate. His portfolio includes high-growth companies such as Mono, PiggyVest, Reliance HMO, and Paystack, acquired by Stripe in 2020. Kola serves as Chair of the Advisory Group on Technology and Creativity to the President of Nigeria and Co-Chair of the Committee on Job Creation & Youth Employment. He also sits on several boards, including ARM Financial Advisers.

Arash Ferdowsi

Co-founder, Dropbox

Arash Ferdowsi is a pioneering Iranian-American entrepreneur who co-founded Dropbox – the cloud-based file-syncing service — in 2007 with Drew Houston, a fellow student at the Massachusetts Institute of Technology. In September 2007, Ferdowsi moved his company to San Francisco and raised venture capital from Sequoia Capital, Accel Partners, Y Combinator, and a handful of individual investors. In March 2018, Dropbox underwent an initial public offering, valuing the company at around US$9.2 billion. From the company's estab- lishment in June 2007 until October 2016, Ferdowsi served as the chief technology officer (CTO) of Dropbox.

Arash Ferdowsi

Co-founder, Dropbox

Arash Ferdowsi is a pioneering Iranian-American entrepreneur who co-founded Dropbox – the cloud-based file-syncing service — in 2007 with Drew Houston, a fellow student at the Massachusetts Institute of Technology. In September 2007, Ferdowsi moved his company to San Francisco and raised venture capital from Sequoia Capital, Accel Partners, Y Combinator, and a handful of individual investors. In March 2018, Dropbox underwent an initial public offering, valuing the company at around US$9.2 billion. From the company's estab- lishment in June 2007 until October 2016, Ferdowsi served as the chief technology officer (CTO) of Dropbox.

Giuseppe Stuto

Managing Partner, 186 Ventures

Giuseppe Stuto is the Co-Founder and Managing Partner of 186 Ventures, an Advisor at Ponto and Reggora, and a Mentor at Techstars. He was previously Founder and CEO of Fam/Smack, Inc., which was acquired by DraftKings. Giuseppe also served as COO at Pison, a platform using patented electroneurography (ENG) technology to translate the body’s natural electrical signals into machine-interpretable software events. Earlier in his career, he worked with Techstars Boston as an Accelerator Associate and served as a Business Plan Judge and Mentor at BUILD. Giuseppe studied at Boston University’s Questrom School of Business.

Giuseppe Stuto

Managing Partner, 186 Ventures

Giuseppe Stuto is the Co-Founder and Managing Partner of 186 Ventures, an Advisor at Ponto and Reggora, and a Mentor at Techstars. He was previously Founder and CEO of Fam/Smack, Inc., which was acquired by DraftKings. Giuseppe also served as COO at Pison, a platform using patented electroneurography (ENG) technology to translate the body’s natural electrical signals into machine-interpretable software events. Earlier in his career, he worked with Techstars Boston as an Accelerator Associate and served as a Business Plan Judge and Mentor at BUILD. Giuseppe studied at Boston University’s Questrom School of Business.

Murtaza Ahmed

Managing Partner, Chiltern Street Capital

Murtaza is the CEO and Managing Partner of Chiltern Street Capital, a venture capital and private equity firm. He was previously Managing Partner at SoftBank’s Latin America Fund and earlier worked at the Vision Fund. He began his career at Deutsche Bank before joining Goldman Sachs, where he became Managing Director at 30 and led the Emerging Markets Structuring team. Murtaza serves on the board of EMPower, a global philanthropy supporting at-risk youth in emerging markets. A Cambridge mathematics graduate and Eton College alumnus, he is also an avid runner, having completed four marathons, and enjoys hiking, skiing, and football.

Murtaza Ahmed

Managing Partner, Chiltern Street Capital

Murtaza is the CEO and Managing Partner of Chiltern Street Capital, a venture capital and private equity firm. He was previously Managing Partner at SoftBank’s Latin America Fund and earlier worked at the Vision Fund. He began his career at Deutsche Bank before joining Goldman Sachs, where he became Managing Director at 30 and led the Emerging Markets Structuring team. Murtaza serves on the board of EMPower, a global philanthropy supporting at-risk youth in emerging markets. A Cambridge mathematics graduate and Eton College alumnus, he is also an avid runner, having completed four marathons, and enjoys hiking, skiing, and football.

Olumide Soyombo

Founder

Olumide Soyombo is the co-founder of Bluechip Technologies Ltd, a systems integration and technology consulting firm he launched in 2008. Under his leadership, the company has grown from two employees to over 100 consultants across Nigeria, Ghana, Zambia, Kenya, and the DRC. He is also the founder of Voltron Capital, a venture capital firm focused on seed investments across Africa, with a portfolio of more than 20 startups including Paystack, Thrive Agric, Trove, and Accounteer. Olumide holds a BSc in Systems Engineering from the University of Lagos and an MSc in Business and Information Technology from Aston Business School.

Olumide Soyombo

Founder

Olumide Soyombo is the co-founder of Bluechip Technologies Ltd, a systems integration and technology consulting firm he launched in 2008. Under his leadership, the company has grown from two employees to over 100 consultants across Nigeria, Ghana, Zambia, Kenya, and the DRC. He is also the founder of Voltron Capital, a venture capital firm focused on seed investments across Africa, with a portfolio of more than 20 startups including Paystack, Thrive Agric, Trove, and Accounteer. Olumide holds a BSc in Systems Engineering from the University of Lagos and an MSc in Business and Information Technology from Aston Business School.

Olumide Soyombo

Founder

Olumide Soyombo is the co-founder of Bluechip Technologies Ltd, a systems integration and technology consulting firm he launched in 2008. Under his leadership, the company has grown from two employees to over 100 consultants across Nigeria, Ghana, Zambia, Kenya, and the DRC. He is also the founder of Voltron Capital, a venture capital firm focused on seed investments across Africa, with a portfolio of more than 20 startups including Paystack, Thrive Agric, Trove, and Accounteer. Olumide holds a BSc in Systems Engineering from the University of Lagos and an MSc in Business and Information Technology from Aston Business School.

Arash Ferdowsi

Co-founder

Arash Ferdowsi is a pioneering Iranian-American entrepreneur who co-founded Dropbox – the cloud-based file-syncing service — in 2007 with Drew Houston, a fellow student at the Massachusetts Institute of Technology. In September 2007, Ferdowsi moved his company to San Francisco and raised venture capital from Sequoia Capital, Accel Partners, Y Combinator, and a handful of individual investors. In March 2018, Dropbox underwent an initial public offering, valuing the company at around US$9.2 billion. From the company's estab- lishment in June 2007 until October 2016, Ferdowsi served as the chief technology officer (CTO) of Dropbox.

Arash Ferdowsi

Co-founder

Arash Ferdowsi is a pioneering Iranian-American entrepreneur who co-founded Dropbox – the cloud-based file-syncing service — in 2007 with Drew Houston, a fellow student at the Massachusetts Institute of Technology. In September 2007, Ferdowsi moved his company to San Francisco and raised venture capital from Sequoia Capital, Accel Partners, Y Combinator, and a handful of individual investors. In March 2018, Dropbox underwent an initial public offering, valuing the company at around US$9.2 billion. From the company's estab- lishment in June 2007 until October 2016, Ferdowsi served as the chief technology officer (CTO) of Dropbox.

Arash Ferdowsi

Co-founder

Arash Ferdowsi is a pioneering Iranian-American entrepreneur who co-founded Dropbox – the cloud-based file-syncing service — in 2007 with Drew Houston, a fellow student at the Massachusetts Institute of Technology. In September 2007, Ferdowsi moved his company to San Francisco and raised venture capital from Sequoia Capital, Accel Partners, Y Combinator, and a handful of individual investors. In March 2018, Dropbox underwent an initial public offering, valuing the company at around US$9.2 billion. From the company's estab- lishment in June 2007 until October 2016, Ferdowsi served as the chief technology officer (CTO) of Dropbox.

Yao Li

Managing Partner

Yao is a Principal at Goodwater Capital, a global venture capital and private equity firm backing exceptional consumer tech entrepreneurs to change the world for good. Before joining Goodwater, she led Corporate Development and Business Operations & Partnerships at Robinhood, the commission-free trading platform for U.S. investors. She also co-founded Context Insights, a global alternative data provider delivering predictive insights for investors, governments, and industries through the collective wisdom of crowds. Earlier in her career, Yao worked as a Research Analyst at J.P. Morgan Investment Bank. She holds a Bachelor’s degree in Economics from Harvard University and an MBA from the MIT Sloan School of Management, where she was recognized as a matriculation scholar.

Yao Li

Managing Partner

Yao is a Principal at Goodwater Capital, a global venture capital and private equity firm backing exceptional consumer tech entrepreneurs to change the world for good. Before joining Goodwater, she led Corporate Development and Business Operations & Partnerships at Robinhood, the commission-free trading platform for U.S. investors. She also co-founded Context Insights, a global alternative data provider delivering predictive insights for investors, governments, and industries through the collective wisdom of crowds. Earlier in her career, Yao worked as a Research Analyst at J.P. Morgan Investment Bank. She holds a Bachelor’s degree in Economics from Harvard University and an MBA from the MIT Sloan School of Management, where she was recognized as a matriculation scholar.

Yao Li

Managing Partner

Yao is a Principal at Goodwater Capital, a global venture capital and private equity firm backing exceptional consumer tech entrepreneurs to change the world for good. Before joining Goodwater, she led Corporate Development and Business Operations & Partnerships at Robinhood, the commission-free trading platform for U.S. investors. She also co-founded Context Insights, a global alternative data provider delivering predictive insights for investors, governments, and industries through the collective wisdom of crowds. Earlier in her career, Yao worked as a Research Analyst at J.P. Morgan Investment Bank. She holds a Bachelor’s degree in Economics from Harvard University and an MBA from the MIT Sloan School of Management, where she was recognized as a matriculation scholar.

Giuseppe Stuto

Managing Partner

Giuseppe Stuto is the Co-Founder and Managing Partner of 186 Ventures, an Advisor at Ponto and Reggora, and a Mentor at Techstars. He was previously Founder and CEO of Fam/Smack, Inc., which was acquired by DraftKings. Giuseppe also served as COO at Pison, a platform using patented electroneurography (ENG) technology to translate the body’s natural electrical signals into machine-interpretable software events. Earlier in his career, he worked with Techstars Boston as an Accelerator Associate and served as a Business Plan Judge and Mentor at BUILD. Giuseppe studied at Boston University’s Questrom School of Business.

Giuseppe Stuto

Managing Partner

Giuseppe Stuto is the Co-Founder and Managing Partner of 186 Ventures, an Advisor at Ponto and Reggora, and a Mentor at Techstars. He was previously Founder and CEO of Fam/Smack, Inc., which was acquired by DraftKings. Giuseppe also served as COO at Pison, a platform using patented electroneurography (ENG) technology to translate the body’s natural electrical signals into machine-interpretable software events. Earlier in his career, he worked with Techstars Boston as an Accelerator Associate and served as a Business Plan Judge and Mentor at BUILD. Giuseppe studied at Boston University’s Questrom School of Business.

Giuseppe Stuto

Managing Partner

Giuseppe Stuto is the Co-Founder and Managing Partner of 186 Ventures, an Advisor at Ponto and Reggora, and a Mentor at Techstars. He was previously Founder and CEO of Fam/Smack, Inc., which was acquired by DraftKings. Giuseppe also served as COO at Pison, a platform using patented electroneurography (ENG) technology to translate the body’s natural electrical signals into machine-interpretable software events. Earlier in his career, he worked with Techstars Boston as an Accelerator Associate and served as a Business Plan Judge and Mentor at BUILD. Giuseppe studied at Boston University’s Questrom School of Business.

Asuka Tsuzuki

President

Asuka Tsuzuki is the President of the Japan University of Economics (JUE) and Vice Chairperson of the Tsuzuki Education Group, one of Japan’s leading private education networks. Appointed president at 30, she became the youngest female university leader in Japan. A third-generation educator, Asuka continues her family’s legacy of innovation founded in 1956. Guided by the philosophy of “Wakon Eisai”—preserving Japanese spirit while embracing global ideas—she has built partnerships with over 100 institutions in 30 countries. Passionate about nurturing global citizens, she promotes modern learning through initiatives like the student-led “Blue Rose” team and courses in eSports, anime, and entertainment management.

Asuka Tsuzuki

President

Asuka Tsuzuki is the President of the Japan University of Economics (JUE) and Vice Chairperson of the Tsuzuki Education Group, one of Japan’s leading private education networks. Appointed president at 30, she became the youngest female university leader in Japan. A third-generation educator, Asuka continues her family’s legacy of innovation founded in 1956. Guided by the philosophy of “Wakon Eisai”—preserving Japanese spirit while embracing global ideas—she has built partnerships with over 100 institutions in 30 countries. Passionate about nurturing global citizens, she promotes modern learning through initiatives like the student-led “Blue Rose” team and courses in eSports, anime, and entertainment management.

Asuka Tsuzuki

President

Asuka Tsuzuki is the President of the Japan University of Economics (JUE) and Vice Chairperson of the Tsuzuki Education Group, one of Japan’s leading private education networks. Appointed president at 30, she became the youngest female university leader in Japan. A third-generation educator, Asuka continues her family’s legacy of innovation founded in 1956. Guided by the philosophy of “Wakon Eisai”—preserving Japanese spirit while embracing global ideas—she has built partnerships with over 100 institutions in 30 countries. Passionate about nurturing global citizens, she promotes modern learning through initiatives like the student-led “Blue Rose” team and courses in eSports, anime, and entertainment management.

Murtaza Ahmed

Managing Partner

Murtaza is the CEO and Managing Partner of Chiltern Street Capital, a venture capital and private equity firm. He was previously Managing Partner at SoftBank’s Latin America Fund and earlier worked at the Vision Fund. He began his career at Deutsche Bank before joining Goldman Sachs, where he became Managing Director at 30 and led the Emerging Markets Structuring team. Murtaza serves on the board of EMPower, a global philanthropy supporting at-risk youth in emerging markets. A Cambridge mathematics graduate and Eton College alumnus, he is also an avid runner, having completed four marathons, and enjoys hiking, skiing, and football.

Murtaza Ahmed

Managing Partner

Murtaza is the CEO and Managing Partner of Chiltern Street Capital, a venture capital and private equity firm. He was previously Managing Partner at SoftBank’s Latin America Fund and earlier worked at the Vision Fund. He began his career at Deutsche Bank before joining Goldman Sachs, where he became Managing Director at 30 and led the Emerging Markets Structuring team. Murtaza serves on the board of EMPower, a global philanthropy supporting at-risk youth in emerging markets. A Cambridge mathematics graduate and Eton College alumnus, he is also an avid runner, having completed four marathons, and enjoys hiking, skiing, and football.

Murtaza Ahmed

Managing Partner

Murtaza is the CEO and Managing Partner of Chiltern Street Capital, a venture capital and private equity firm. He was previously Managing Partner at SoftBank’s Latin America Fund and earlier worked at the Vision Fund. He began his career at Deutsche Bank before joining Goldman Sachs, where he became Managing Director at 30 and led the Emerging Markets Structuring team. Murtaza serves on the board of EMPower, a global philanthropy supporting at-risk youth in emerging markets. A Cambridge mathematics graduate and Eton College alumnus, he is also an avid runner, having completed four marathons, and enjoys hiking, skiing, and football.

Join our community. No filters. No fluff. Just the good emails.

Rank Microfinance Bank is licensed by CBN

Insured by

Contact

Learn

Policies & Terms

Nigeria

11b Ologun Agbaje, VI, Lagos, Nigeria

United States

San Francisco 548 Market St, San Francisco, California, 94104-5401

Join our community. No filters. No fluff. Just the good emails.

Rank Microfinance Bank is licensed by CBN

Insured by

Contact

Learn

Policies & Terms

Nigeria

11b Ologun Agbaje, VI, Lagos, Nigeria

United States

San Francisco 548 Market St, San Francisco, California, 94104-5401

Join our community. No filters. No fluff. Just the good emails.

Rank Microfinance Bank is licensed by CBN

Insured by

Contact

Learn

Policies & Terms

Nigeria

11b Ologun Agbaje, VI, Lagos, Nigeria

United States

San Francisco 548 Market St, San Francisco, California, 94104-5401

Join our community. No filters. No fluff. Just the good emails.

Rank Microfinance Bank is licensed by CBN

Insured by

Learn

Policies & Terms

Nigeria

11b Ologun Agbaje, VI, Lagos, Nigeria

United States

San Francisco 548 Market St, San Francisco, California, 94104-5401